AP Syllabus focus:

‘Commodity dependence describes economies relying on a narrow set of export commodities, which can produce vulnerability and uneven development.’

Commodity dependence arises when countries rely heavily on exporting a few primary goods, shaping development patterns, exposing economies to risks, and influencing global economic relationships and spatial inequalities.

Commodity Dependence and Global Economic Structure

Commodity dependence occurs when a country relies on a limited range of primary commodities—such as oil, minerals, or agricultural products—for a substantial share of its export revenues. These commodities are typically low in value-added production and subject to volatile global prices. In the context of development geography, commodity dependence highlights how unequal trade relationships and structural economic weaknesses can shape spatial patterns of wealth and poverty.

Commodity Dependence: A condition in which a country relies on one or a small number of primary commodities to generate a large portion of its export income.

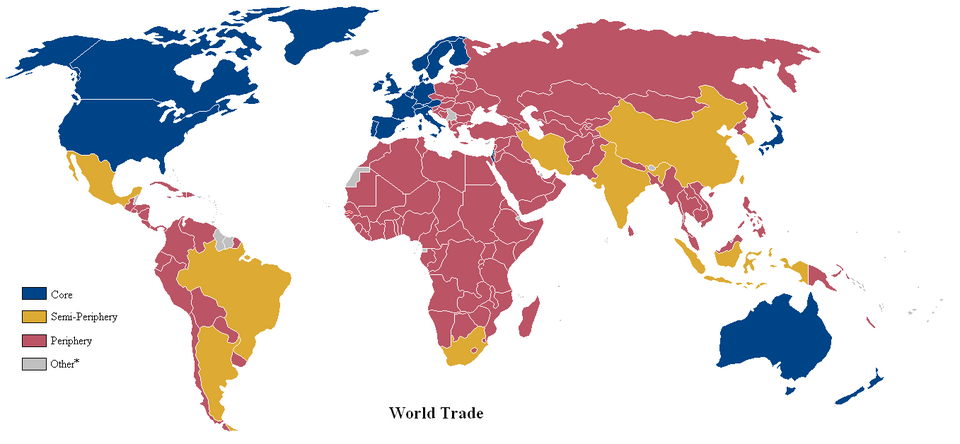

The link between commodity dependence and global economic hierarchies is central to AP Human Geography because it shows how core, semiperiphery, and periphery regions interact within global markets.

World map of countries categorized as core, semiperiphery, and periphery in the global trading system. This map helps illustrate how commodity-dependent economies are often located in the periphery, exporting raw materials to core regions. It includes more detail than the syllabus requires by distinguishing several intermediate categories within the world-system. Source.

Why Commodity Dependence Develops

Historical and Structural Roots

Commodity dependence often stems from historical processes such as colonization, during which colonial powers structured economies around the extraction of raw materials rather than the development of diversified industries. These patterns persisted after independence, leaving many countries with economic structures built on exporting cash crops, minerals, or fuels.

Limited Industrialization

Because dependent economies typically lack strong secondary or tertiary sectors, they face obstacles in creating domestically controlled manufacturing and service industries. This can reinforce a cycle in which countries export raw materials and import more expensive finished goods.

Economic Vulnerabilities of Commodity-Dependent States

Price Volatility

Global commodity prices can shift dramatically due to changes in demand, geopolitical events, supply disruptions, and speculation. For countries reliant on one or two major exports, even small price drops can cause large losses in national income, government revenue, and employment.

Uneven Development

Commodity dependence can lead to uneven geographic development, where investment and growth concentrate in regions producing the export commodity. Other areas may remain underserved, creating internal disparities in income, infrastructure, and opportunity.

Revenue Instability and Debt

Because export revenues fluctuate, governments may struggle to fund public services, prompting increased borrowing. When commodity prices fall, debt burdens can worsen, constraining development efforts further.

Political and Social Implications

Risk of the “Resource Curse”

The resource curse describes how resource-rich countries sometimes experience slower economic growth, weaker democratic institutions, and higher corruption levels. This can happen when commodity wealth centralizes political power, reduces incentives to develop diversified industries, or heightens competition for control over valuable resources.

Resource Curse: A paradox in which countries with abundant natural resources experience negative economic or political outcomes such as corruption, conflict, or stagnation.

This situation often creates societal instability and undermines long-term development by concentrating wealth among elites and limiting broad-based economic participation.

Labor Issues

Commodity industries frequently rely on seasonal, low-wage, or hazardous labor. Workers in these sectors may lack job security, protections, and opportunities for upward mobility. Dependence on a few industries can leave workers vulnerable to downturns or mechanization.

Geographic Patterns of Commodity Dependence

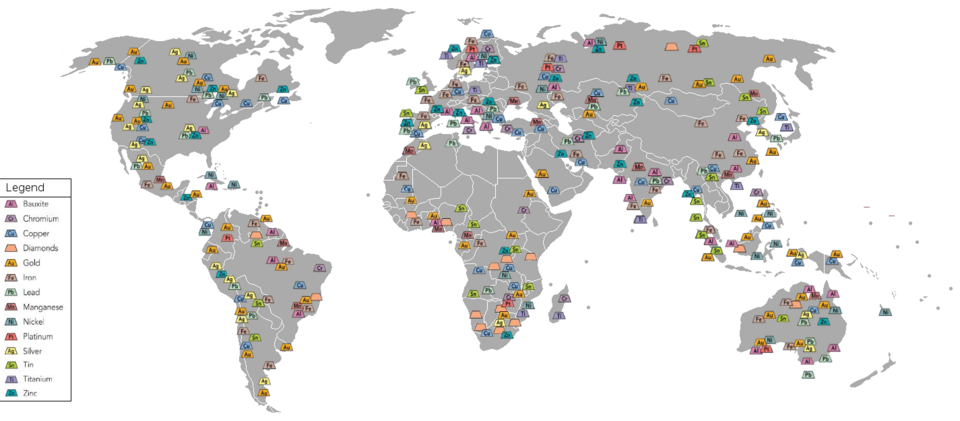

Spatial Concentrations

Commodity dependence is particularly common in regions of the periphery, including parts of Sub-Saharan Africa, Latin America, the Middle East, and Central Asia.

Schematic world map showing major mining regions and important ore deposits, with a focus on metals and construction materials. This visual emphasizes how mineral resources are unevenly distributed, helping explain why some states specialize in exporting primary commodities. It includes additional details such as landfill mining and environmentally preferable mining sites that extend beyond syllabus requirements but remain geographically helpful. Source.

Global Trade Networks

Commodity-dependent countries are tightly linked to global trade networks dominated by core economies and transnational corporations. These networks shape:

Production chains, where commodities flow outward while knowledge-intensive goods flow inward.

Trade relationships, often characterized by unequal bargaining power.

Investment patterns, with foreign companies controlling extraction and export facilities.

Development Challenges and Opportunities

Barriers to Diversification

Economic diversification is a major challenge because commodity-dependent states may have limited capital, weak infrastructure, or insufficient human development indicators. High dependence can also crowd out other sectors when governments focus investment on extraction industries or when currency appreciation reduces competitiveness for manufacturing.

Opportunities for Value Addition

Despite obstacles, some commodity-dependent countries pursue strategies to move up the value chain. These include:

Developing processing industries to refine raw materials domestically.

Implementing local content policies to require foreign companies to employ local workers or purchase local inputs.

Encouraging innovation in agriculture or mining through technology and training.

Environmental Pressures

Commodity extraction often has major environmental impacts, including deforestation, soil degradation, water contamination, and greenhouse gas emissions. These effects can threaten long-term sustainability and increase vulnerability to climate change, especially in rural communities dependent on ecosystem health.

Commodity Dependence and Uneven Global Development

Commodity dependence remains a powerful force shaping national development outcomes. By relying on exports of a narrow set of goods, countries face economic instability, political risks, environmental challenges, and persistent spatial inequalities. Understanding how commodity dependence interacts with global economic systems helps explain why development levels vary sharply between and within countries.

FAQ

Commodity dependence is usually assessed by calculating the percentage of a country’s total export revenue that comes from primary commodities. Countries are typically labelled as commodity-dependent when more than 60 per cent of their exports consist of raw materials.

International organisations may also classify dependence by category, such as fuels, minerals, or agricultural goods, allowing comparisons across regions.

Diversification requires investment, skilled labour, and infrastructure, which are often limited in countries whose revenues fluctuate with global commodity prices.

High earnings from one export can also create a disincentive to invest in new sectors, particularly when governments rely heavily on commodity taxation for income. This is sometimes reinforced by foreign companies controlling extraction and associated profits.

A strong inflow of foreign currency from commodity exports can cause the national currency to appreciate. This makes manufactured goods from the country more expensive abroad, reducing competitiveness.

This phenomenon, often called ‘Dutch Disease’, can hinder the growth of secondary and tertiary sectors, reinforcing reliance on commodities.

Yes. Commodity booms can attract internal migrants to mining or oil-producing regions due to increased employment opportunities.

However, when prices fall, job losses may trigger out-migration, leading to population instability. Rural communities may also experience long-term economic decline if their livelihoods rely on commodities affected by changing global markets.

Not always. The benefits depend on how much value is retained locally.

Countries with strong regulatory systems may require foreign firms to employ local workers, share profits, or develop local infrastructure. In weaker governance contexts, more benefits may flow abroad, deepening economic inequality and limiting long-term development gains.

Practice Questions

(1–3 marks)

Explain what is meant by the term ‘commodity dependence’.

Explain what is meant by the term ‘commodity dependence’.

1 mark: Identifies that commodity dependence involves reliance on exporting primary commodities.

2 marks: States that a small number or narrow range of commodities dominate export earnings.

3 marks: Explains that this reliance can shape development outcomes or create vulnerability due to price fluctuations.

(4–6 marks)

Using examples, explain how commodity dependence can create economic and political challenges for countries in the periphery.

Using examples, explain how commodity dependence can create economic and political challenges for countries in the periphery.

1 mark: States that commodity dependence makes economies vulnerable to global price fluctuations.

1 mark: Identifies uneven development or limited economic diversification as a challenge.

1 mark: Explains how reliance on commodity exports can lead to unstable government revenues or increased debt.

1 mark: Describes political risks such as corruption, conflict over resources, or the resource curse.

1 mark: Provides at least one appropriate real-world example (e.g., oil dependence in Nigeria, copper in Zambia, or minerals in the Democratic Republic of Congo).

1 mark: Clearly links the example(s) to the consequences described.